Stripe Terminal’s expanding ecosystem: New partnerships bring flexibility and innovation to unified commerce

Enterprises such as Hertz, Shopify, and URBN are increasingly choosing Stripe Terminal to build modern in-person payments experiences. Today, we’re excited to announce a host of partnerships that allow Terminal to work with more third-party hardware, processors, and point-of-sale (POS) systems. This provides more choice and flexibility for integrating Terminal into your existing in-person payment stack and adding innovative checkout experiences.

Today’s announcements include:

- A new partnership with FreedomPay, a leader among independent third-party gateways

- New direct integrations with leading POS providers

- New composable hardware solutions with major Android manufacturers

Partnering with FreedomPay to better serve large enterprises

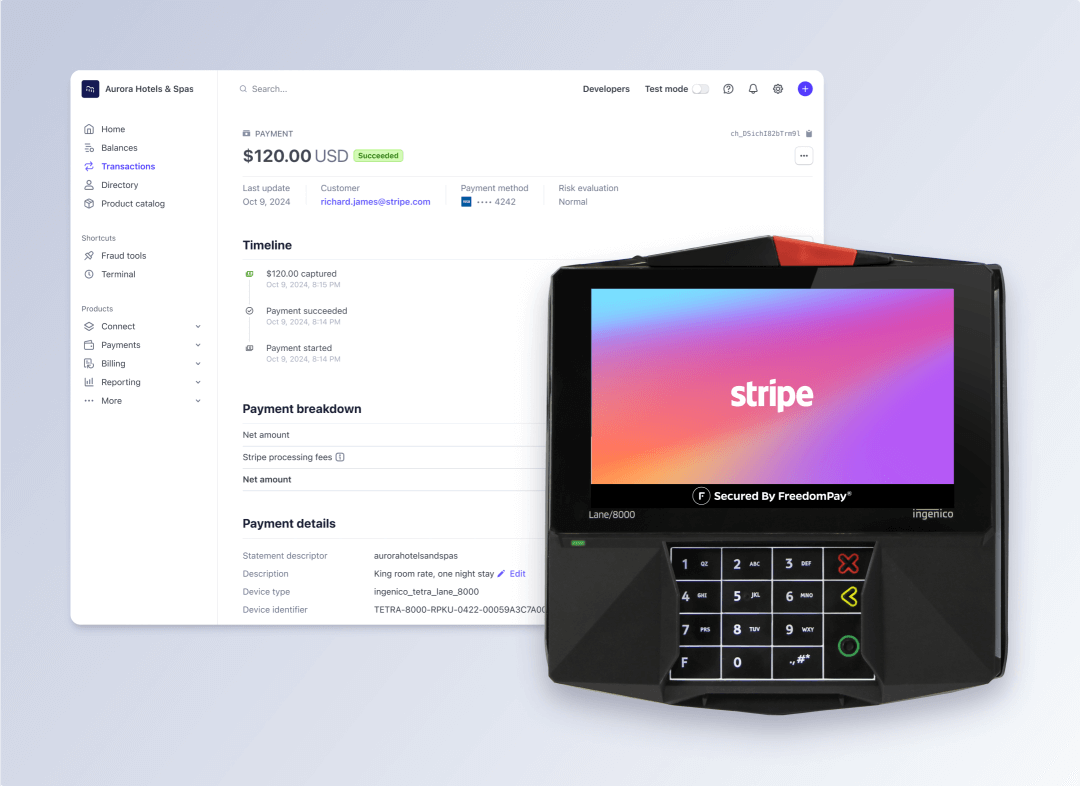

Many of our platform users appreciate the flexibility to integrate their own custom POS app with Terminal. But large enterprises often come to Stripe with existing tech stacks and preferences about which POS and hardware systems they want to use. We’ve formed a new partnership with FreedomPay to provide additional flexibility for enabling enterprise-grade payments. FreedomPay offers best-in-class commerce orchestration, unifying not just POS systems and payments providers, but also loyalty programs, private label cards and gift cards, and customer analytics.

Through this new partnership, you can:

- Future-proof your existing payments stack. Now, you can combine Stripe’s payments suite—including Payments, fraud protection, and authorization optimizations—with over 1,000 FreedomPay-supported POS systems, plus third-party card readers, gift card flows, and more. You can also use Stripe for in-person payment processing alongside other payment service providers (PSPs). This broad compatibility allows you to keep your existing setup while preserving future flexibility to switch POS and hardware providers should the need arise.

- Unify reporting at the highest levels. Large enterprises often use multiple payment processors or operate across different lines of business. This could be a hotel chain that opens a line of restaurants under a different POS, or a parent company with multiple brands. Now it is possible to get consolidated views of your payments data—across channels, business lines, and payment processors.

“We are excited for this partnership to combine FreedomPay’s advanced payment tech functionality with Stripe’s industry-leading payments reliability and innovation. Together we can better serve more large enterprises and power their unified commerce needs,” said Chris Kronenthal, president of FreedomPay.

Sign up to learn more about using Stripe with FreedomPay.

Growing our list of direct POS connectors

If you prefer a full-stack solution that works with your existing POS, you can now go live faster with an expanded list of “connectors.” These are direct integrations between the Terminal SDK and leading third-party POS or property management systems. Our newest connectors are for Cegid and Oracle Xstore. They join connectors for Adobe, Oracle OPERA, Retail Realm, Tulip, Mercaux, Erply, and more, which we announced earlier this year.

After expanding to the US, Colombian retailer Tennis used Stripe’s Cegid connector to go live with a unified online and in-person payments solution with Stripe in under two weeks.

“When we opened our first stores in the United States, we were using a payments provider and terminals that weren’t integrated with our POS Cegid. This meant that our store associates had to manually enter the amounts to charge, which increased checkout times and created room for error—as happens whenever a process has a manual component. We chose to work with Stripe because they offer modern readers, reliable payments, and a direct integration to Cegid. The integration process was fast and easy. Switching to Stripe has greatly reduced friction for both our customers and sales representatives,” said José Fernando Arango Jiménez, IT director at Tennis.

Investing in POS hardware composability

In addition to advances in software interoperability, we are extending our support for new types of hardware. Traditionally, businesses have relied on dedicated EMV-certified readers and peripherals such as registers and printers to accept in-person payments. We’re building for a future where contactless payment acceptance continues to grow and users need more than traditional payments hardware.

Tap to Pay on Android allows users to accept payments directly using contactless technology on a wide variety of compatible Android phones and tablets. With Tap to Pay, enterprises can supplement their countertop readers with devices that allow for untethered mobile checkout, while startups can reduce overhead and use their existing phones or tablets to accept payment.

We’re working closely with leading Android manufacturers—including Samsung, Elo, and SUNMI—to enable these new use cases and give you more choice in your hardware setup. Our goal is to help you go to market faster with innovative form factors, such as touch-screen kiosks (which can support scenarios such as semiattended checkout) and devices with customer-facing displays (which can improve engagement).

Already, Stripe users such as Oddle, HitPay, Snackpass, and Lopay are taking advantage of this flexibility by using Tap to Pay on Android across 50+ unique Android devices. Qromo—an all-in-one management software for businesses in the hospitality and retail sectors—recently adopted Tap to Pay on Android to provide more flexibility to food trucks, restaurants, and hotels.

“We are beginning to see our users leverage the newest and most innovative Android products on the market to accept in-person payments with Stripe, including the newly released SUNMI V3 MIX that allows businesses to manage orders and take payments seamlessly on one device,” said Francesco Basile, CEO and founder of Qromo.

Expanding applications for NFC technology

Contactless payments are enabled by NFC technology, and we think Tap to Pay is just the first of many potential use cases it can facilitate to benefit customers. To help users keep pace in a complex and rapidly changing landscape, we are partnering with card networks to explore a range of innovative “Tap” experiences that have the potential to extend applications of NFC technology:

- Tap to Add. The customer can tap their card to their mobile phone to add and save a card for future purchases.

- Tap to Own. The customer can tap their card to their mobile phone to complete a purchase, rather than manually entering card details. This is helpful in cases where the checkout or customer doesn’t use a mobile wallet.

- Tap to Verify. The customer might be asked to tap their card to their mobile phone when completing an online or in-app purchase as an extra verification method for transactions that are flagged as potentially risky. This confirms that the user does have the card in their possession and can improve fraud signals for businesses such as DoorDash, which has partnered with Stripe to launch a Tap to Verify pilot.

We’re continuing to conduct a limited pilot with select users and will share more at future Stripe events. Availability may differ by region.

To learn more about integrating your current tech stack with the expanding Terminal ecosystem, or implementing innovative customer experiences, please get in touch.