Platforms can now white label payment workflows in record time

More than 13,000 platforms use Stripe Connect to serve the payments needs of over 8 million small businesses and solopreneurs. Embedded payments are now a key revenue line for many large software platforms, but tapping into this opportunity entails a staggering amount of complexity. This includes understanding payments regulations, engineering compliant solutions, and maintaining payment workflows over time—all while creating exceptional user experiences.

Our customers tell us that they want to own this embedded payments experience, but don’t want to reallocate many months of engineering resources to build and maintain payments from scratch.

At Sessions last month, we announced 17 new embedded components to offer the best of both worlds: exceptional user experiences with minimal development effort. Built on top of Connect, these components package up our industry-leading payments capabilities into embedded components that you can copy and paste into your application. Each of these components turns what could have been a months-long project for a full team into just a few days of work for one engineer, and they eliminate ongoing maintenance costs.

This post highlights four ways embedded components can simplify the most complex payment workflows for platforms expanding to a new market or looking to reduce operational overhead.

Create localized onboarding flows across 118 countries

Onboarding is an important first step in creating a positive user experience. It’s also a massive undertaking that involves regulatory compliance, ID verification, and ongoing maintenance needs. These challenges only compound when you scale into new markets or launch new business models.

Our embedded component for onboarding lives directly in your website, and dynamically adapts to support onboarding flows across 118 countries and 45 languages. It also localizes business logic. For example, when a customer from Hong Kong goes through the onboarding flow, the component recognizes and validates the format of Hong Kong Identity Card numbers. The onboarding component also automatically updates as country or compliance requirements change.

MYOB, a multinational business management software platform, used embedded components to dramatically reduce the amount of time it spent expanding its payments offering to New Zealand. The team launched its entire payments functionality to a new market in just eight weeks, and can now expand into new markets without any additional work.

“We were able to add embedded components into existing workflows and use onboarding to effectively plug and play where we had gaps in our platform experience. This allowed us to go live much faster and keep our engineers focused on other tasks,” said Steve Price, head of product at MYOB.

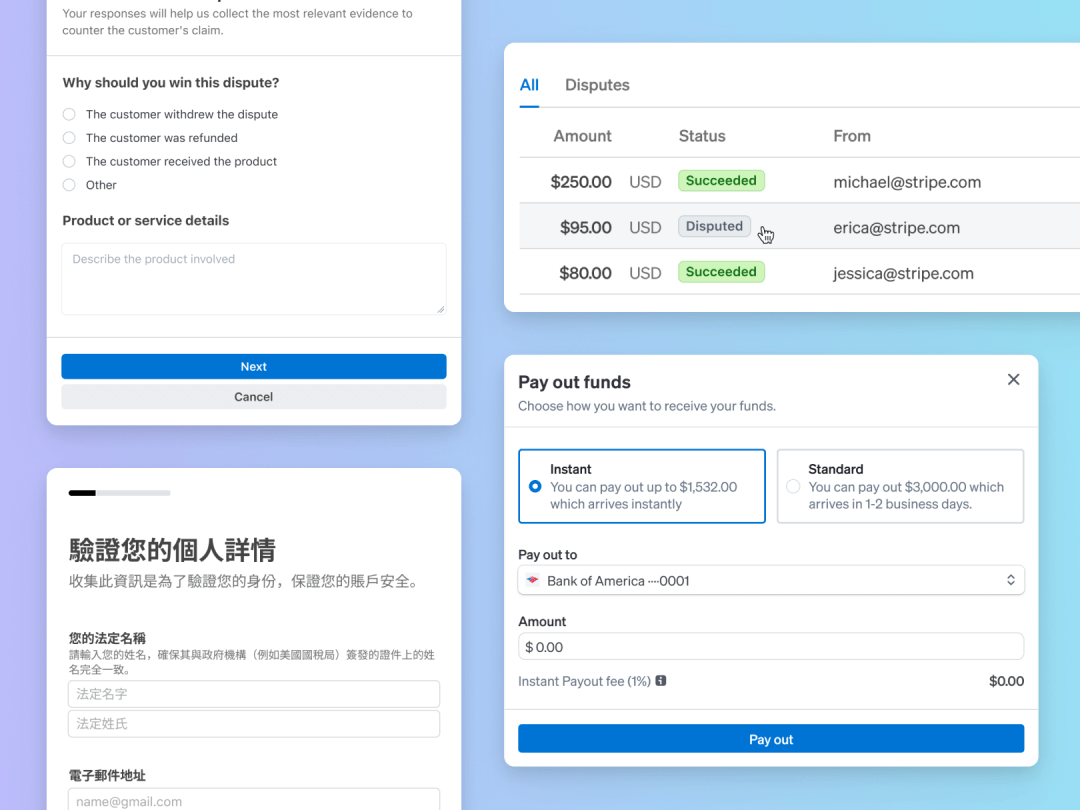

Manage complicated dispute workflows in a fraction of the time

Platforms tell us that without embedded components, they have no good choices when it comes to supporting their users for handling payments disputes: either they dedicate an entire support team to the task of helping their users collect and submit disputes, or they manage the disputes directly themselves, taking on additional revenue risk in the process. Both options are time-consuming and error-prone.

The payments list embedded component offers customized logic and prebuilt UIs for connected accounts to manage their own disputes. By using the component, your team no longer needs to understand hundreds of different dispute reason codes. Instead, the payments list embedded component automatically customizes the dispute workflow for businesses on your platform based on the reason code. For connected accounts, the prebuilt UI walks them through each step of the resolution workflow, from providing the required evidence to tracking the status of a dispute.

“Embedded components help us simplify the dispute handling process. We estimate that it’ll reduce the time it takes to handle disputes by 70%. They also provide control to our customers and allow us to operate as a lean team,” said Aditya Srivathsan, director of payments at Thinkific.

Help your customers offer a better checkout experience

Your users can expand customer reach, increase conversion, and lower transaction costs by offering a diverse set of payment methods. However, it can take months of engineering resources to integrate and maintain each payment method that your customers request. The new embedded component for local payment method settings allows you to enable up to 18 different payment methods with just a few clicks. Your users can simply toggle different payment methods on or off, choosing between cards, wallets, ACH, and buy now, pay later methods. As we add support for more payment methods, the component will update automatically, removing the need for your team to invest in ongoing maintenance.

Improve payout visibility and timing

Cash flow management is a top priority for any business your platform serves, and it’s often the difference between success and failure. Instant Payouts, which gives connected accounts instant access to their funds, helps businesses stay cash-flow positive, but it’s not a plug-and-play solution. Platforms still need to create a custom UI for many pieces of functionality, such as providing users with the ability to view their balance or change their payout schedule.

Our payouts component eliminates the need to build this UI from scratch. Instead, you can give connected accounts visibility into their funds with an embedded dashboard displaying a payout balance summary, a list of all payouts, and a payout schedule. In the same dashboard you can give connected accounts the option to access their funds within minutes, for a small fee, creating a new revenue stream for your platform.

“Instant Payouts is one of those things the old model couldn’t do because of the constraints of our financial system. Stripe’s infrastructure of real-time money movement makes it possible. We work hard to reduce friction for our customers, and we love how Stripe does the same thing for its users,” said Trevor Johnston, cofounder and co-CEO at Jane.app.

Offer a seamless customer experience beyond payments

Embedded payments are just the start of supporting all your users’ needs directly from your platform. To that end, we’ve extended embedded components across the breadth of Stripe products with seven more components (in preview) that support embedded financial services—such as cards, bank account alternatives, and lending—as well as Stripe Tax and our broader Apps ecosystem.

With all these components, our goal is the same: to empower you to offer a customized, best-in-class user experience without requiring you to take on the added complexity of building it from scratch.

Get started with embedded components today, or explore the components in action on Furever.dev, a fictional platform for dog groomers.