Our biggest-ever upgrades to Stripe Billing

Earlier this month at Stripe Tour New York, we shared new ways to orchestrate and grow your revenue with Stripe Billing. First, we announced the largest change we’ve ever made to Billing: the ability to manage subscriptions with Stripe while processing transactions with other payments providers. We also introduced a host of new features to help you better understand your revenue data and give you more flexibility in how you bill for usage. Let’s take a closer look at everything we launched.

Use Billing with third-party payment processors

In April we announced a major shift in how Stripe operates, by making our services more modular and interoperable so that they fit into your existing technology stack. We started by allowing you to use Stripe’s optimized checkout features even if other companies process your payments. You’ve been asking us to extend this interoperability: in particular, large users with complex payment stacks comprising multiple processors want to use Billing to manage their recurring revenue.

Last month, we announced that we’re rolling out the ability for you to use Billing with third-party payment processors in certain regions. You will be able to integrate Billing with third-party payments providers to create subscriptions that automatically process payments with a third-party processor, manage subscription states, and track payment success for external payments (subject to availability).

Join the private preview to integrate Billing with your own payment processor.

Easily analyze subscription data to understand, optimize, and forecast performance

Historically, you could understand the overall health of your subscription business on Stripe by tracking active subscribers, monthly recurring revenue (MRR), churn rate, and customer lifetime value. While this allowed you to get a big-picture view of your revenue, you also wanted the ability to segment data and access underlying metrics so you could make better business decisions, faster.

Our new analytics and reporting features help you do just that. You can now:

- Segment data by product and price, and drill down to understand the underlying causes of MRR changes, analyze historical trends, and accurately forecast SaaS performance

- Explore your revenue data further by running custom queries in Sigma, or save time with our built-in AI-powered assistant, which instantly transforms your business questions into answers

- Consolidate your Stripe revenue data with other business information by exporting it to any data warehouse

You can access these new reporting features in the Stripe Dashboard using the Explore functionality.

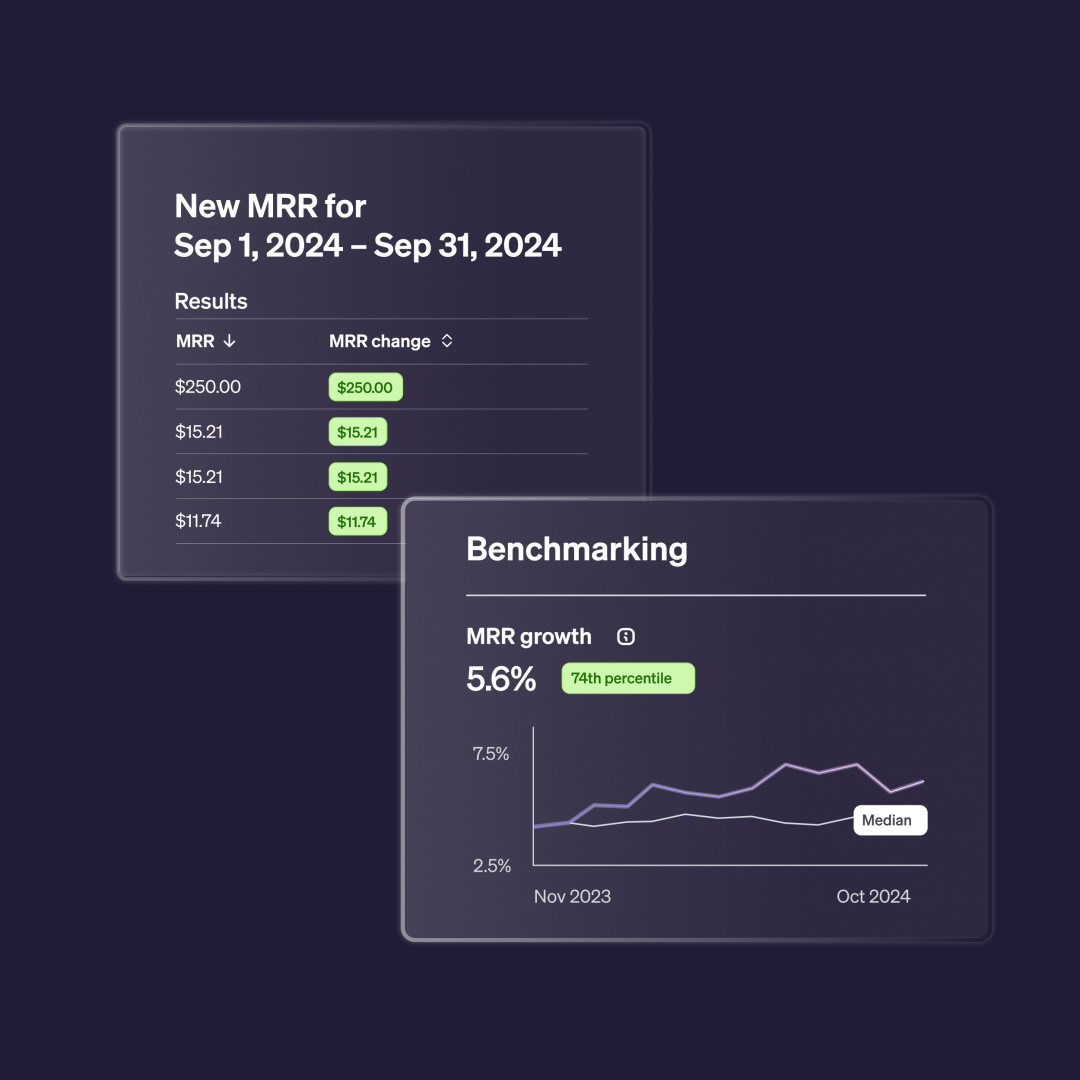

Benchmark your performance against similar businesses on Stripe

Once you understand your business’s performance, you might want to know how it compares to similar companies in your industry. This kind of comparative analysis helps you identify areas for improvement and set realistic goals, but the majority of businesses aren’t able to get this information on their own.

With Billing, you can now benchmark your business performance against similar businesses on Stripe to understand where you’re excelling or where improvements can be made. For example, you can see how your MRR growth, subscription failure rates, and churn rates compare against others. Our benchmarking feature is powered by insights from the entire Stripe network, making it one of the most comprehensive in the market.

Visit the benchmarking page in the Dashboard to evaluate your company’s performance against similar companies that use Stripe.

Do more with usage-based billing, from new pricing models to faster data ingestion

More than 80% of SaaS companies want to charge based on usage, but this can be a complex, lengthy process. You have to ingest data in real time, link it to existing pricing systems and customer bills, and connect that information to the other systems you use to manage revenue.

To reduce this complexity, we launched our usage-based billing solution earlier this year. Now, we’re further improving usage-based billing by allowing you to:

- Offer credit burndown pricing models to help your customers prepay for usage. You can configure credit grants in the Dashboard or via the Meters API.

- Set thresholds and alerts to notify your business teams when a preset limit for usage or spend has been reached, making it easy to identify trends and potential upgrade targets. You can set up an alert on the Billing Alerts page in the Dashboard.

- Report more usage data to Stripe with higher throughput (up to 100,000 events per second), which reduces delays and billing errors. Contact sales to request access to higher throughput.

- Add up to a 72-hour grace period on invoices with automated collections, so you can accurately bill your customers by including usage data from third parties in the proper billing cycle. You can configure the grace period by visiting the Invoice settings page in the Dashboard.

With usage-based billing’s additional monetization options, deeper analytics, and better ingestion rates, you can now more easily create a usage-based model that is tailored to your business needs.

Supporting your growth

Every new feature release or improvement listed here is driven by your feedback and requests. Our goal is to give you all the building blocks you need to bill and manage users however you want. As we continue to improve Billing, we’d love to hear what you want us to build next.

To learn more about how Billing can accelerate your growth, read our docs or get in touch with an expert from our team.