More locally relevant ways to pay in Japan

Since we launched in Japan five years ago, our domestic and international users have told us that they want to pursue deeper, more natural relationships with their Japanese customers. Our Japan-based engineering teams have made major progress in unlocking larger portions of the economy for our users, and today we’re announcing support for Konbini payments and bank transfers (known locally as Furikomi) on Stripe.

Bank transfers: bringing Japanese companies together

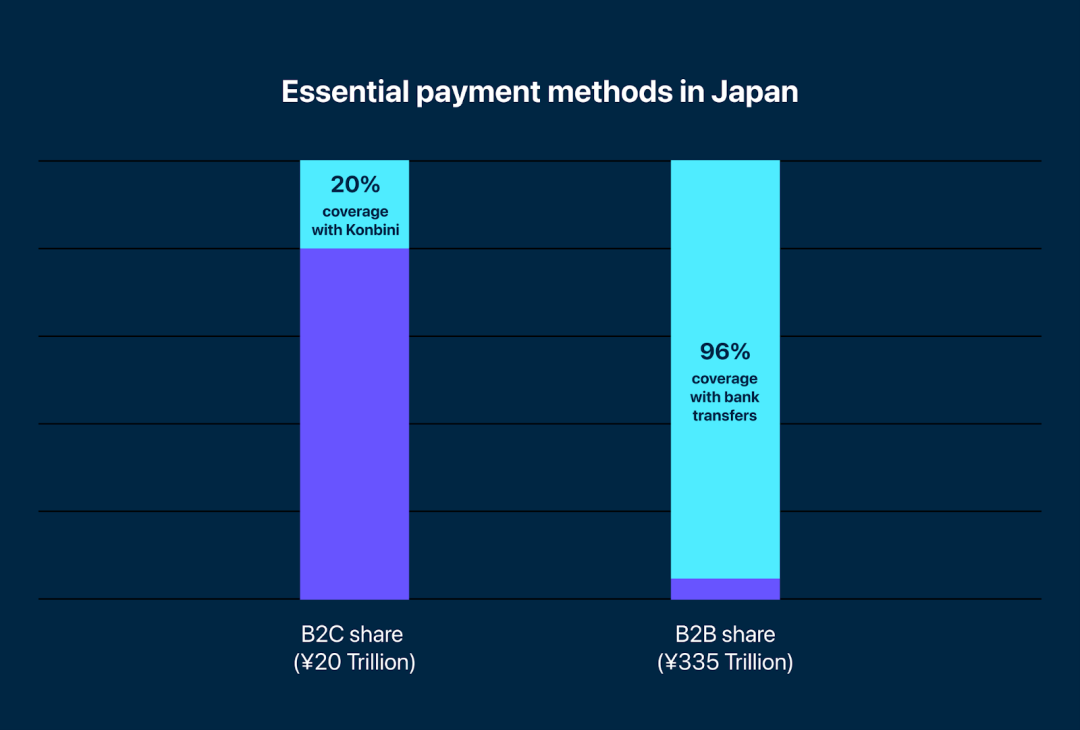

In Japan, the daily rhythms of the economy depend on payments between businesses, and these are overwhelmingly facilitated by bank transfers, which the Ministry of Economy, Trade, and Industry (METI) estimates have 96% share of the ¥335 trillion ($2.7 trillion) that is exchanged annually. Our customers can now use bank transfers throughout Stripe products, allowing them to get closer than ever to their Japanese business counterparties.

We are modernizing the experience for bank transfers for both the sending and receiving firms. We allow businesses to automatically provision virtual bank accounts, instead of having all customers transfer to the same corporate bank account. This allows fast, automatic processing of invoices, avoiding the common end-of-month scramble as accounting teams attempt to reconcile outstanding invoices and (largely opaquely labeled) incoming transfers.

Bank systems and business systems don’t usually talk to each other. This needlessly complicates routine work, from accounting to customer service, and introduces risk and errors. We made bank transfers legible to non-bank systems, allowing businesses to build on top of them. For example, bank transfers do not naturally support refunds in the same way that card payments do. We have made partial and full refunds available both within our Dashboard and API, so that customer service teams can reverse a ‘typoed’ transfer without needing full access to a corporation’s treasury account.

Bank transfers open new possibilities for marketplaces and SaaS platforms. With Stripe Connect, marketplaces can accept payments on behalf of their end-users without needing to expose end-user banking details directly to customers. SaaS platforms can finally tie their offerings directly to cash received by the business. This will give them new revenue opportunities, easier ROI justification for customers, and the ability to build richer experiences for their business users.

We have also deeply integrated bank transfers in Stripe’s Billing suite. It comes with beautiful invoices, support for manual and automated reconciliation of invoices, subscription functionality, optional hosted subscription and customer portal UIs, and much more. Stripe Billing is everything a business in Japan needs to get paid. It scales from sending a startup’s first invoice to powering some of the most sophisticated companies in the world. KDDI Web Communications, a subsidiary of one of Japan’s leading telecommunications companies, uses it to manage subscription billing for their Garoon teleconferencing service.

Konbini payments: bringing the internet into the real world

We also newly support payments at over 34,000 convenience stores, called Konbinis, across Japan. Konbini payments allow users without access to cards, or who prefer the predictability of cash payments, to pay for online purchases at their local convenience store. The ubiquity of Konbinis makes them the 2nd most common payment method for Japanese e-commerce, after cards, with 18% of the nearly ¥20 trillion ($167 billion) online B2C payment volume (again per METI).

Konbini payments help connect local businesses throughout Japan with their customers across the country, and Stripe’s support makes them viable for the first time for small businesses. Previously, bespoke negotiations, onboarding, and integration costs meant only larger businesses could offer Konbini payments. We have made accepting them as straightforward as accepting cards, at a price as low as 120 yen (about $1) per transaction.

We also substantially improved the end-user experience. Until now, businesses have had to handhold users through chain-specific details about payment or some of their transactions will never complete. We developed a hosted experience where users can pick the store closest to them, changing on the fly if necessary, and we present accurate, up-to-date instructions in their preferred language. Centralizing this ongoing effort at Stripe saves each of our hundreds of thousands of Japanese users from having to keep these instructions refreshed themselves. We also, for the first time in the industry, made it possible to easily refund Konbini payments automatically.

Built with Japanese craftsmanship

Our engineering teams in Japan led Stripe’s global engineering efforts in rolling out these new payment methods and the fully integrated experiences with our Billing, Checkout, and other platforms. We love that the internet allows us to bring global reach to local contexts, and felt it appropriate that Konbini support be built by engineers who viscerally understand how important it is to transact smoothly during a busy lunch hour.

The engineering talent pool in Japan is extremely deep. Japanese technical products have made their mark on the world, and are particularly often cited by Stripes worldwide as to why they joined the tech industry. We are thrilled to be able to bring that talent to bear on problems impacting the entire world, while also improving the ability of other Japanese companies to participate in the global internet economy on an equal footing.

We have supported businesses from Osaka’s storied Morisawa type foundry to leading business networking solutions provider Sansan for five years now. Japanese users we work with are optimistic about their prospects, and we are enthusiastic about supporting their delivery of quality and delight to their customers, wherever in the world they are.

Businesses looking to get started with Konbini or bank transfers in Japan can do so easily from the Dashboard or reach out to us to learn more.