How prebuilt checkout pages maximize efficiency

When Stripe first launched, we made it easier for businesses to design their own online payment forms while minimizing the PCI burden. In the past 10 years, however, online commerce has become more complicated.

Businesses are now expected to offer any number of mobile wallets, like Apple Pay, Google Pay, and Alipay. New regulations (like PSD2 in Europe) have led to broader 3D Secure adoption, which has made payment flows more complicated. And that’s when cards are used at all: eighty percent of new internet users are based in regions where local, non-card payment methods with custom payment flows are the norm. When you consider having to adapt to changing browser standards, making online payment forms responsive to mobile devices, and translating them into local languages, the cost of maintaining a high-conversion, compliant payment form quickly becomes significant and growing.

In short: Stripe made it easy to build a basic credit card form. But it’s getting increasingly hard to build a first-class checkout page.

Building a first-class checkout page

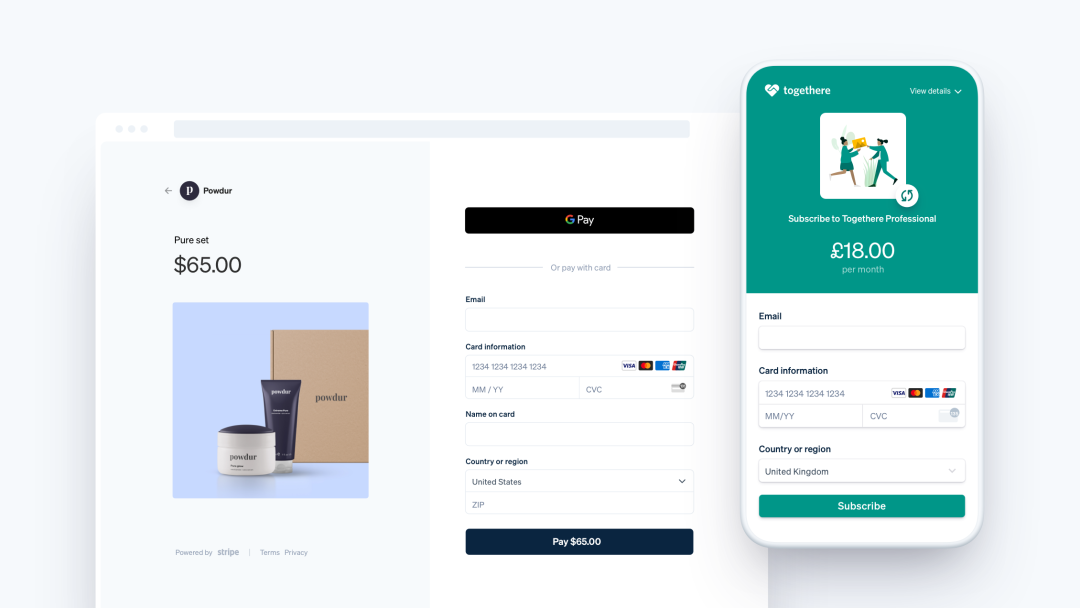

When we first launched Stripe Checkout, our prebuilt, hosted payment page, we imagined that it would be useful for people who didn’t want to write any frontend code. While Checkout is indeed very easy to use, we’ve since realized that Checkout’s real value is in making checkout pages more powerful. Unless you intend to support all of the edge-cases yourself (address-autocomplete that works with native autofill, 3D Secure on mobile, Alipay on Desktop…), you’ll likely increase your revenue and save many engineering hours by using Checkout.

Stripe Checkout is one of my single favourite products ever made and it has allowed us to do so much with Ghost that we would not have been able to accomplish otherwise.

Using Stripe Checkout just made it a lot simpler to think about payments—it’s like an entire component that we can mentally hand off to Stripe.

Throughout my 20 years in e-commerce, checkouts were the last thing you wanted to touch and the first to go down. With Stripe Checkout we don’t maintain this ourselves anymore. It’s the future savings—I can’t emphasize enough how big that is.

Increasing your sales with a better checkout flow

What does that mean in practice? Well, teams of Stripe engineers and designers obsess over every aspect of the checkout page, from reducing load time to streamlining how customers fill in their addresses. We sweat the details to an extent that would be irrational for nearly any company building their own checkout flow.

Stripe Checkout adapts to each customer down to their location, device, browser, and individual user settings. For example, Checkout automatically surfaces the right payment methods based on your customer’s location—you don’t have to run A/B tests to identify the highest converting payment methods in Belgium. We just handle it for you. If a customer in Japan accidentally has their keyboard set to full-width characters, we’ve done the work to ensure they can seamlessly complete their purchase without needing to build CJK numeral support. (If you don’t quite know what that means, that’s the point! We’ve handled the edge case.)

Always improving

Today, we’re adding support for coupons, tax rates, and two new payment methods. These mark the latest in a series of over 20 major releases in the last year. Checkout now offers a seamless customer experience with out-of-the-box support for mobile wallets and address auto-complete, helps scale your business globally with over 25 languages and 10 international payment methods, and lets you customize payments for your business with support for tax rates, promo codes, brand configuration tools, and more.

You get the benefit of all this and everything that’s to come: even faster load times, additional payment methods we add, compliance with future payment method regulations, and every optimization we make to maximize conversion—all without major code changes on your end. This helps you increase sales with less work, benefiting from our investment in making the world’s safest, best converting checkout experience.

Explore Checkout or let us know how we can make Checkout work better for you.